Secure Your Adventure: The Ultimate Overview to Automobile Insurance Coverage Protection

Looking for the supreme overview to auto insurance protection? From comprehending policy restrictions and deductibles to finding the appropriate insurance coverage provider, we'll show you the ropes. Bend up and obtain ready to protect your ride with the finest car insurance policy protection out there!

Sorts Of Cars And Truck Insurance Coverage

When selecting cars and truck insurance policy coverage, it is crucial to comprehend the different types available to you. One kind of insurance coverage you need to take into consideration is responsibility insurance coverage.

An additional kind of coverage to think about is collision insurance coverage. This coverage helps spend for fixings to your own car if it is damaged in a crash with one more lorry or object, no matter that is at fault. It can be especially valuable if you have a more recent or a lot more expensive vehicle.

Thorough insurance policy is additionally worth taking into consideration. This protection assists safeguard your car against damages from non-collision occurrences, such as theft, criminal damage, fire, or all-natural calamities - Insurance Agency Lake Worth FL. It can supply satisfaction knowing that you are covered in a vast array of situations

Lastly, uninsured/underinsured driver coverage is essential to have. This insurance coverage assists protect you if you are associated with an accident with a motorist who does not have insurance coverage or does not have sufficient coverage to spend for your problems or injuries. It can help cover clinical expenses, lost incomes, and various other problems.

Comprehending the different kinds of cars and truck insurance policy coverage available to you is crucial in making a notified choice. It is essential to examine your demands, assess the dangers, and pick the coverage that finest suits your scenario and budget.

Understanding Policy Restrictions and Deductibles

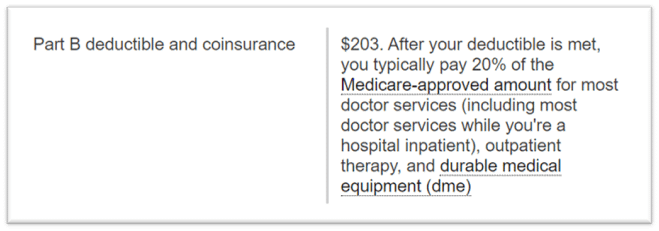

To completely understand your automobile insurance policy protection, it is vital to understand the principle of plan restrictions and deductibles. Policy limits refer to the maximum amount your insurer will certainly spend for an insurance claim. These limitations are commonly split into two categories: bodily injury obligation and property damages obligation. Bodily injury obligation covers the clinical costs, lawful costs, and shed incomes of the various other event associated with a crash you are in charge of. Property damages obligation covers the repair or substitute prices of the various other celebration's lorry or residential or commercial property. It's important to choose policy restrictions that appropriately protect your properties, as you can be held personally in charge of any kind of prices surpassing your coverage. Deductibles, on the various other hand, are the amount you need to pay out of pocket before your insurance policy starts. Higher deductibles typically result in reduced premiums, while lower deductibles mean greater costs. Understanding your plan limitations and deductibles is important to make sure that you have the appropriate protection and are prepared for any unexpected cases when driving.

Elements That Affect Auto Insurance Coverage Premiums

One vital variable that affects your auto insurance coverage costs is the variety of mishaps you have been associated with. Insurance policy companies consider your accident history as an action of risk. If you have remained in numerous accidents, it suggests a greater likelihood of future accidents, which increases the risk for the insurer. Because of this, your premiums will be greater to make up for this increased risk - Insurance Agency Lake Worth FL.

Another element that affects your auto insurance premiums is your driving record. Insurance companies check out your previous driving actions, consisting of any kind of website traffic violations or tickets you may have gotten. If you have a history of speeding tickets or other violations, it suggests a higher risk of accidents, which will cause greater premiums.

Your age and sex can likewise influence your cars and truck insurance coverage premiums. Younger drivers, specifically young adults, are thought about greater danger due to their absence of driving experience. Likewise, male chauffeurs tend to have actually greater premiums contrasted to female drivers as a result of statistical data revealing that they are much more vulnerable to crashes.

Tips for Discovering the Right Car Insurance Policy Provider

To locate the best auto insurance coverage provider, you must start by contrasting quotes from different firms. This will offer you a concept of the price array and coverage alternatives available to you. The most affordable choice might not always be the ideal choice. Search for a provider that uses a balance of cost and top quality coverage.

When comparing quotes, make sure to take into consideration the particular needs of your vehicle and your driving behaviors. If you have a brand-new or costly vehicle, you may desire to focus on extensive protection to safeguard against theft or damage. If you have a long commute or regularly drive in high-traffic locations, you might wish to concentrate on finding a company that provides good roadside support and accident mercy.

In addition to comparing quotes, it is necessary to look into the reputation and financial security of prospective insurance service providers. Look for customer testimonials and scores to get a concept of exactly how satisfied previous customers have actually been with their protection and customer support.

Lastly, do not fail to remember to consider any kind of price cuts or benefits that might be offered to you. Many insurance policy providers offer discount rates for safe driving, numerous policies, or membership in certain organizations. Taking benefit of these discounts can assist you conserve money while still obtaining the coverage you require.

Actions to Take After a Mishap: Filing a Claim

After contrasting quotes and choosing the best car insurance provider, the next action is to know the steps to take after a crash: submitting a case. It is very important to act promptly and efficiently to make sure a smooth procedure. Make sure everybody entailed is risk-free and call the needed emergency situation services if needed. Next, gather all the needed details, such as the various other chauffeur's insurance coverage details, call details, and any witness statements. Take photos of the accident scene and any type of noticeable damage to your vehicle. Then, inform your insurance policy service provider immediately. They will certainly guide you through the claims process and offer you with the needed types to fill in. Be sincere and supply exact details when completing the kinds. As soon as you have actually sent your insurance claim, your insurance policy business will evaluate the details and establish the level of insurance coverage. They may send out an insurer to assess the damages and supply a quote for repair work. Finally, make sure to keep an eye on all interaction and documentation pertaining to the crash and your insurance claim. Adhering to these actions will visit site help ensure a efficient and smooth cases process.

Verdict

So, remember to always secure your experience by having the best automobile insurance coverage. Understand plan limits and deductibles, consider factors that affect premiums, and take the time to discover the ideal insurance policy provider.

Looking for the utmost guide to cars and truck insurance policy protection? Bend up and obtain ready to secure your trip with the best automobile insurance protection out there!

When selecting auto insurance policy protection, it is vital to understand the different types available to you.To fully understand your cars and truck insurance policy protection, it is necessary to comprehend the idea of policy restrictions and deductibles.So, bear in mind to constantly protect your trip by having the right vehicle insurance policy protection.